Share

Banks in India are now using AI avatars for loan recovery. These virtual agents make video calls and send messages to borrowers. This method is cheaper and more efficient than using human agents. Private banks are adopting this technology. Public sector banks are also considering it. The goal is to improve loan repayment rates while adhering to RBI guidelines. Missed a loan repayment? You might soon get a video call from a woman dressed like a lawyer or a man in a sharp business suit. The tone is brisk bordering on aggressive; the language sprinkled with legalese. Meet the new loan collection agents – AI-generated avatars. The idea – as with the human version – is to make you click on the payment button. Almost all major private sector banks and financial institutions are using these services provided by collection agencies and say it’s not only lowered costs but also increased efficiency.

“At present, most banks and financial institutions use a mix of these products, which includes AI-generated video calling, text messages and then, in more troublesome cases, follow-ups by real-life agents,” said a bank executive, noting that public sector banks (PSBs) are yet to adopt the technology. “Most banks have outsourced their collection business and the ones which do it internally hire such firms for technology support.” Service providers include Credgencis, Oriserve and Sarvam AI, said an industry executive, noting that state-run banks, through the PSB Alliance, are also looking at this avenue.

Cheaper Resource:

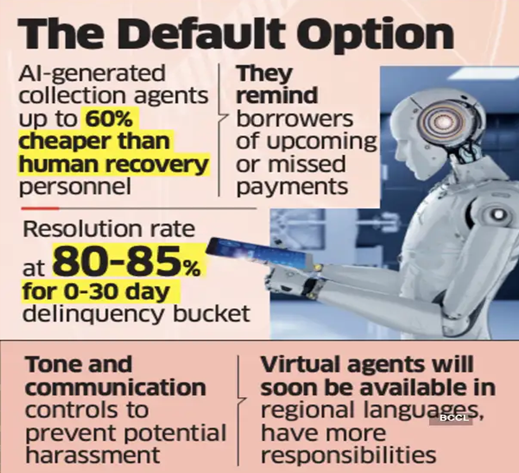

According to Rishabh Goel, Cofounder and CEO of Credgenics, the future of debt collection will be defined by empathetic and AI-powered interactions. The firm’s advanced virtual collection bots are already supporting leading banks such as ICICI Bank, HDFC Bank and Yes Bank as well as NBFCs such as L&T Finance in engaging with borrowers to remind them of upcoming or missed payments. According to industry estimates, while a human collection agent costs up to ₹30,000 per month with a monthly average caseload of 250, an AI agent, which can make at least 20 times more calls, is 40-60% cheaper. “The resolution rate is 80-85%, especially in the zero-to-30-day delinquency bucket, mostly in cases of personal loans or commercial vehicle loans,” said the industry executive cited above. Since they can keep going indefinitely, AI virtual calling agents have a better chance of connecting with borrowers. And, they keep getting better at the job while staying polite, a line that can be crossed by their human counterparts. “We are advancing scenario-based learning and intelligent response mechanisms, enabling AI collection bots to engage with borrowers more thoughtfully and responsibly,” said Goel. This is something that lenders say they’re conscious about. “While service providers are claiming that guardrails are in place, it needs to be seen whether the latest versions do not breach any regulatory guidelines,” said a bank executive with a state-run bank. Under Reserve Bank of India (RBI) guidelines, financial institutions and their recovery agents cannot call borrowers before eight in the morning and after seven in the evening. The guidelines further mandate that regulated entities and their recovery agents shall not resort to intimidation or harassment of any kind, either verbal or physical, against any person in their debt collection efforts, including acts intended to humiliate publicly or intrude upon the privacy of the debtors or their guarantors’ family members.

Source : https://economictimes.indiatimes.com/industry/banking/finance/banking/missed-a-loan-repayment-banks-are-deploying-ai-agents-to-follow-up-heres-how/articleshow/124032371.cms?from=mdr