Share

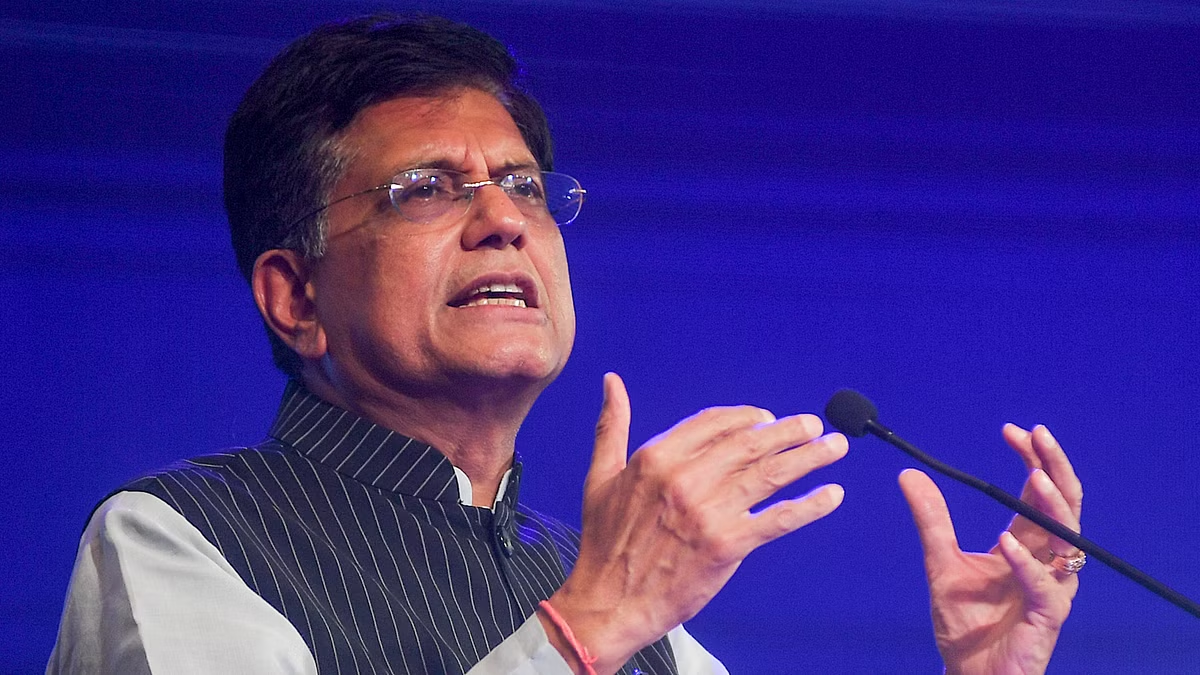

At least eight venture capital and private equity firms from the US and India have teamed up to launch the India Deep Tech Investment Alliance (IDTA) to mobilise private capital and expertise for deep-tech companies in the South Asian nation. The group, which will also work to strengthen US-India deep tech collaboration, counts Celesta Capital, Accel, Blume Ventures, Gaja Capital, Ideaspring Capital, PremjiInvest, Tenacity Ventures and Venture Catalysts as its founding members. The alliance said in a statement, it has secured total capital commitments of $1 billion to date and that each member will commit “meaningful private capital” over 5 to 10 years to Indian-domiciled deep-tech enterprises. The IDTA said that its effort ties into the TRUST (Transforming the Relationship Utilising Strategic Technology) framework announced by US President, Trump and Indian Prime Minister, Modi earlier this year. Interestingly ties between India and US have soured in recent weeks after Trump imposed a 50% Tariff on Indian Goods. IDTA members have agreed to invest long-term private capital in Indian startups and scale-ups in fields such as semiconductors, space, quantum, robotics, AI, biotech, medical devices, energy, climate and digital infrastructure. Beyond funding, they plan to provide mentorship, market access and help portfolio companies expand into India.

The group will also act as a channel between members and Government agencies implementing the RDI scheme. Members will co-ordinate on deal flow, due diligence, co-investments and discussions around sector-specific policy and standards. Each member of IDTA will commit meaningful private capital over the next 5 to 10 years to Indian-domiciled deep tech enterprises. Deeptech represents the next frontier of global innovation and we expect great companies to emerge and lead in this space from the US-India corridor,” said Sriram Viswanathan, Founding Managing Partner at Celesta Capital. The alliance will be governed by an advisory committee chaired by Arun Kumar, Managing Partner at Celesta Capital and former Chief Executive Officer of KPMG India. Other members of the committee include representatives from Accel, PremjiInvest and Venture Catalysts. “We will bring our investment expertise and intend to invest our risk capital over the next 7-10 years in backing innovative companies in these sectors of strategic national importance. Together with Government funding under the RDI scheme, we are confident of creating a globally competitive ecosystem in these critical areas,” said Chief Executive Officer, T K Kurien, PremjiInvest. Over time, the IDTA aims to broaden its membership to include more Indian and global investors willing to commit capital and collaborate in developing India’s deep tech ecosystem.

Source : https://www.vccircle.com/premjiinvestgaja-capital-accel-others-team-up-to-back-indian-deep-tech-startups