Share

In the year 2023, the Department of Investment and Public Asset Management (DIPAM) demonstrated a steadfast commitment to value creation, strategic divestment, and consistent financial planning.

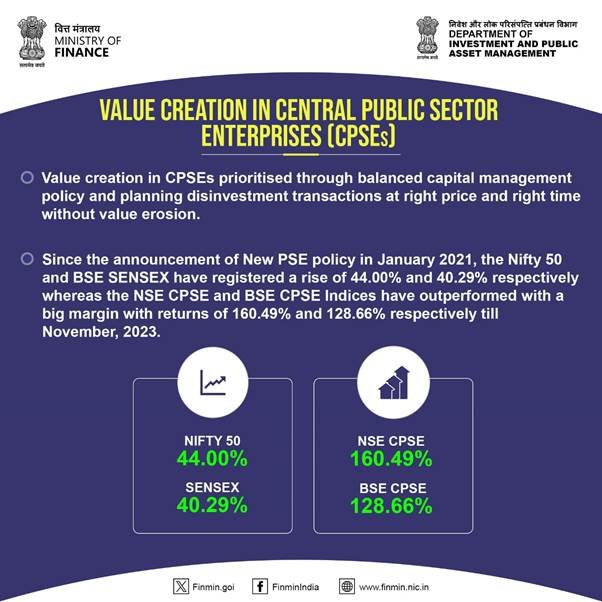

One of the key highlights in 2023 was the emphasis on value creation in Central Public Sector Enterprises (CPSEs). Since the introduction of the New PSE policy in January 2021, the NSE CPSE and BSE CPSE Indices have surpassed benchmarks, showcasing returns of 160.49% and 128.66%, respectively, until November 2023.

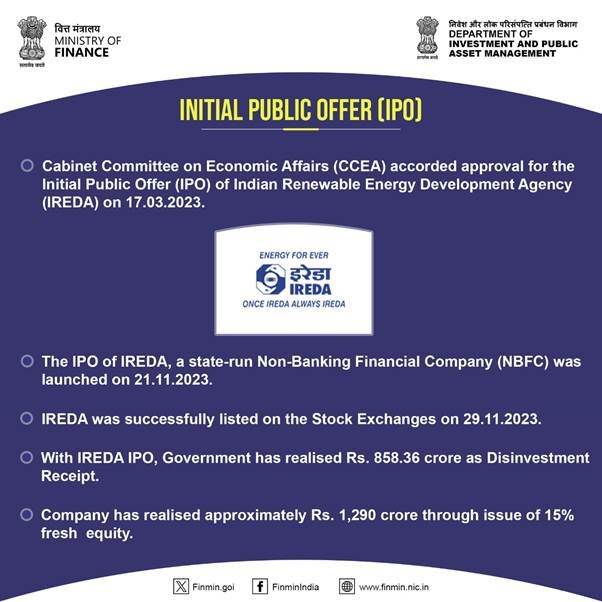

In the realm of Initial Public Offerings (IPO), DIPAM successfully launched the IPO for the Indian Renewable Energy Development Agency (IREDA).

The Offer for Sale (OFS) route has been actively pursued by the government for divesting its shareholding in CPSEs. Noteworthy transactions in CPSEs like HAL, Coal India Limited, RVNL, SJVN Limited, and HUDCO have collectively yielded Rs. 10,860.91 crore. The stocks involved generally experienced an uptrend post-OFS, contributing to capital gains for investors.

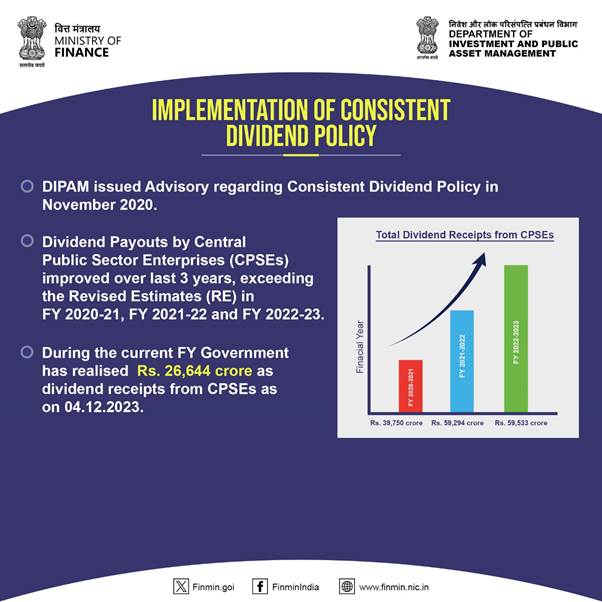

DIPAM’s has also implemented a Consistent Dividend Policy over the years, with the total dividend receipts from CPSEs in FY 2022-23 at an impressive Rs. 59,533 crore, surpassing the Revised Estimates. In the current fiscal year, the government has realised Rs. 26,644 crore as dividend receipts from CPSEs as of December 4, 2023.

Looking ahead, DIPAM is actively pursuing strategic disinvestment in entities such as IDBI Bank Limited, PDIL, HLL Life Care Limited, NMDC Steel Limited, Shipping Corporation of India, and BEML Ltd. with Expressions of Interest (EoIs) have been issued for these transactions.

Following are some of the major achievements of the Department of Investment and Public Asset Management (DIPAM), Ministry of Finance, in 2023:

Value Creation in Central Public Sector Enterprises (CPSEs)

- Value creation in CPSEs prioritized through balanced capital management policy and planning disinvestment transactions at right price and right time without value erosion.

- Since the announcement of New PSE policy in January 2021, the Nifty 50 and BSE SENSEX have registered a rise of 44.00% and 40.29% respectively whereas the NSE CPSE and BSE CPSE Indices have outperformed with a big margin with returns of 160.49% and 128.66% respectively till November, 2023.

Initial Public Offering (IPO)

- CCEA accorded approval for the Initial Public Offering (IPO) of Indian Renewable Energy Development Agency (IREDA) on 17.03.2023.

- The IPO of IREDA, a state-run non-banking financial company (NBFC) was launched on 21.11.2023.

- IREDA was successfully listed on the stock Exchanges on 29.11.2023.

- With IREDA IPO, Government has realized Rs. 858.36 crore as Disinvestment Receipt.

- Company has realized approximately Rs. 1290 crore through issue of 15% fresh equity.

Offer for Sale (OFS)

- Government has continued to divest its shareholding in CPSEs through the Offer for sale (OFS) route.

- Since January 2023, OFS transactions were carried out in HAL, Coal India Limited, RVNL, SJVN Limited and HUDCO and Government realized Rs. 10,860.91 crore (HAL- Rs.2,910.39 crore, Coal India- Rs.4,185.69 crore, RVNLRs.1,365.61 crore, and SJVN- Rs.1,349.27 crore, HUDCO Rs.1,049.95 crore) through these transactions.

- The stocks generally witnessed uptrend post OFS, adding to the capital gains of investors

Implementation of Consistent Dividend Policy

- DIPAM issued Advisory regarding Consistent Dividend Policy in November 2020.

- Dividend Payouts by Central Public Sector Enterprises (CPSEs) improved over last 3 years.

- s. Total dividend receipts from CPSEs in FY 2020-21, FY 2021-22 and FY 2022-23 stood at Rs 39,750 crore, Rs 59,294 crore, and Rs 59,533 crore respectively which exceeds the Revised Estimates (RE) of Rs 34,717 crore, Rs 46,000 crore, and Rs.43,000 crore respectively.

- During the current FY Government has realized Rs. 26,644 crore as dividend receipts from CPSEs as on 04.12.2023.

Strategic Disinvestment

For ongoing transactions, Expression of Interests is issued for strategic disinvestment of IDBI Bank Limited, PDIL, HLL Life Care Limited, NMDC Steel Limited, Shipping Corporation of India, and BEML Ltd.

Source : https://pib.gov.in/PressReleasePage.aspx?PRID=1990757

Related Posts

SEARCH SMECONNECT-DESK

RECENT POST

- THE COUNTDOWN BEGINS: 2ND EDITION OF PACK.NXT 2024 ANNOUNCED!

- Mr. Goyal launches district master plan under PM Gati Shakti for infra planning

- China emerges as India’s top import source during April-September 2024: Commerce ministry data

- Income Tax Department can send income tax notice on these 5 high value cash transactions

- As Gujarat announces new textile policy today, here’s a look at why Maharashtra’s Navapur is being preferred by Surat factory owners