Share

In a significant ruling, the Allahabad High Court has determined that the dishonour of cheques from banks that have merged with another bank does not constitute an offence under Section 138 of the Negotiable Instruments (NI) Act. If a cheque from a merged bank bounces, the issuer will not face prosecution under this section. Justice Arun Singh Deshwal issued this order while considering the petition of Archana Singh Gautam from Banda, concerning a cheque dishonour involving a bank that merged with Indian Bank.

The petitioner had issued a cheque on August 21, 2023, which was presented to the bank on August 25, 2023. The bank declared the cheque invalid and returned it, leading the opposing party to file a cheque bounce complaint under Section 138 of the NI Act. The petitioner then contested the summons order in the High Court.

The court clarified that under Section 138 of the NI Act, if a bank rejects an invalid cheque upon presentation, it does not constitute an offence. Specifically, Allahabad Bank merged with Indian Bank on April 1, 2020, and its cheques were valid only until September 30, 2021. Post this date, if the bank invalidates a presented cheque, a cheque bounce case cannot be established. The court emphasized that for an offence to occur under the NI Act, the cheque must be valid at the time of its issuance.

Related Posts

SEARCH SMECONNECT-DESK

RECENT POST

- THE COUNTDOWN BEGINS: 2ND EDITION OF PACK.NXT 2024 ANNOUNCED!

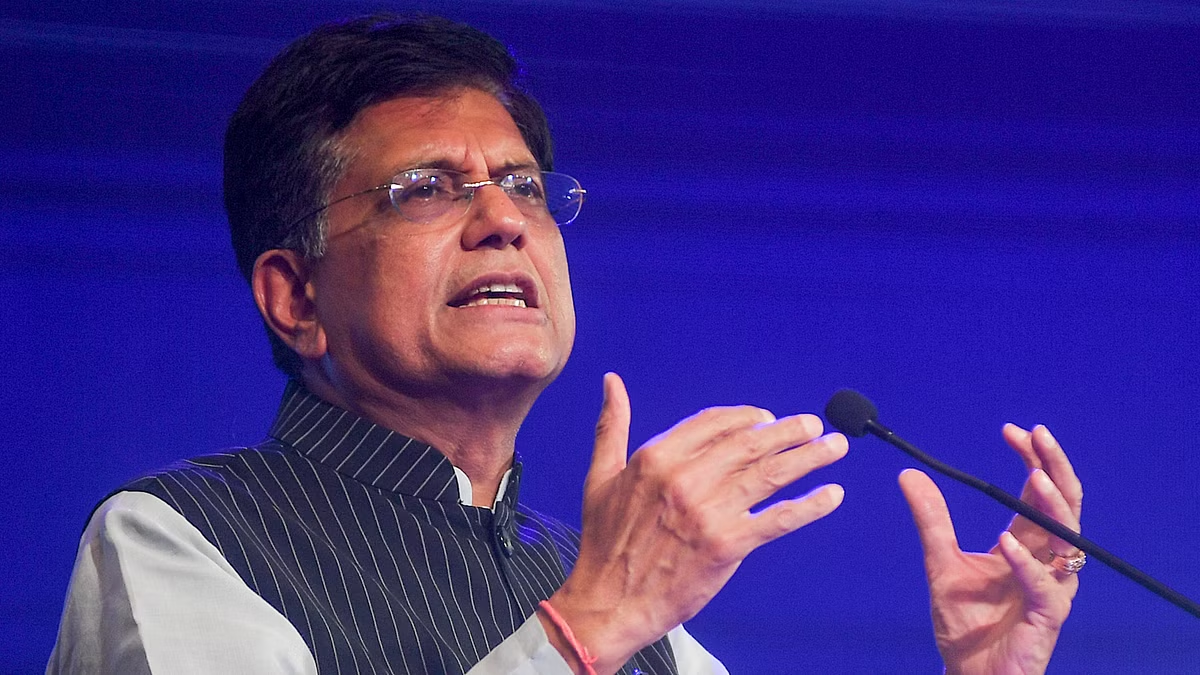

- Mr. Goyal launches district master plan under PM Gati Shakti for infra planning

- China emerges as India’s top import source during April-September 2024: Commerce ministry data

- Income Tax Department can send income tax notice on these 5 high value cash transactions

- As Gujarat announces new textile policy today, here’s a look at why Maharashtra’s Navapur is being preferred by Surat factory owners