Share

The Government with an intent to build a strong ecosystem for nurturing innovation and encouraging investments launched the Startup India initiative on16thJanuary2016.

The Government unveiled an Action Plan for Startups comprising of schemes and incentives envisaged to create a vibrant startup ecosystem in the country. The Action Plan comprises of 19 action items spanning across areas such as “Simplification and handholding”, “Funding support and incentives” and “Industry academia partnership and in cubation”. For attaining specific objectives of the Action Plan, various programs are implemented by the Government under the Startup India initiative to recognize, develop, and empower startup ecosystem.

Under the Startup India initiative, the Government is implementing three flagship Schemes, namely, Fund of Funds for Startups (FFS), Startup India Seed Fund Scheme (SISFS) and Credit Guarantee Scheme for Startups (CGSS) to support start-ups at various stages of their business cycle.

SISFS provides financial assistance to seed stage start-ups through incubators. SISFS has a corpus of Rs.945crore. Specifically for the State of Tamil Nadu, 20incubators have been approved for a total sum of Rs. 86.10 crore and Rs. 43.63 crore has been disbursed to the approved incubator sason31stDecember2023.

FFS has been established to catalyze venture capital investments and is operationalized by Small Industries Development Bank of India (SIDBI), which provides capital to SEBI- registered Alternative Investment Funds (AIFs) who in turn invest in startups. FFS has a corpus of Rs. 10,000 crore. Specifically for the State of Tamil Nadu, SIDBI has committed a total sum of Rs.500crore to 6AIFs and Rs.384crore have been disbursed to the AIFs as on 31stDecember2023.

CGSS is implemented for enabling collateral free loans to the Department for Promotion of Industry and Internal Trade (DPIIT) recognised start-ups through eligible financial institutions. CGSS is operationalized by the National Credit Guarantee Trustee Company (NCGTC) Limited and has been operationalized on pilot basis from1stApri l2023. Specifically for the State of Tamil Nadu, a total of 5 loans amounting to Rs.8.65 crore have been disbursed to eligible recognised startups, as on 31stDecember2023.

For attaining specific objectives,various programsare implemented by the Government under the Startup India initiative. All the steps undertaken by the Government under the said initiative are inclusive and are implemented across States/Union Territories (UTs), cities, towns, and rural areas, including the State of Tamil Nadu. The details of such initiatives are placed as given below:

Sustained efforts by the Government under the Startup India initiative have led to an increase in the number of DPIIT recognised startups from over 300 in 2016 to 1,17,254, as on31st December 2023. Specifically for the State of Tamil Nadu,there are a total of 7,559 DPIIT recognized startups as on 31st December2023.

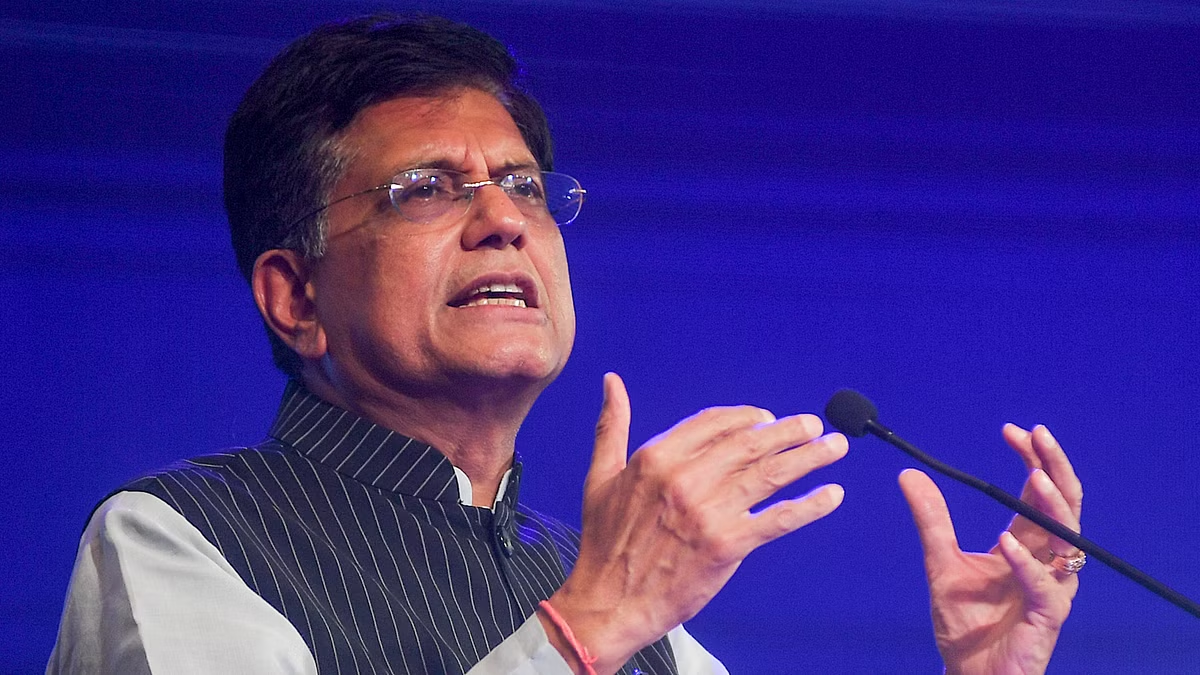

This information has been provided by the Union Minister of State for Commerce and Industry, Shri. Som Parkash in a written reply in the Rajya Sabha today.

Source : https://pib.gov.in/PressReleasePage.aspx?PRID=2005206